Bahrain introduced the value-added tax starting with January 2019 and it is the third country from the six member states of the Gulf Cooperation Council to implement this tax. The Unified VAT Agreement signed by the GCC members made it mandatory for these jurisdictions to implement this type of tax, in a harmonized manner across all of the states. Bahrain, along with the other members, has implemented the main principles of the VAT Agreement in its own VAT legislation. A certain degree of variation for the taxable supplies remains.

| Quick Facts | |

|---|---|

| VAT registration services | We offer VAT registration support in Bahrain. |

|

Standard rate |

10% |

|

Lower rates |

0% for export of goods, supply of products subject to customs duty regimes, transporation services |

| Who needs VAT registration | All entities with an annual turnover of BHD 37,500 |

| Time frame for registration |

A few days |

| VAT for real estate transactions |

Sale, lease and license of real estate is exempt from VAT in Bahrain, all other transactions are subject to the standard rate. |

| Exemptions available |

– healthcare services, – educational services |

| Period for filing |

Monthly and quarterly filings are permitted. |

| VAT returns support |

We offer VAT return filing support in Bahrain. |

| VAT refund | Tourists can apply for VAT returns for the goods purchased in Bahrain and taken out of the country. |

| Local tax agent required |

A local representative must be appointed. |

| Who collects the VAT? |

National Bureau for Revenue |

| Documents for VAT registration |

– company information, – personal information of the company representative, – application form |

| Voluntary VAT registration procedure available |

Voluntary VAT registration is available in Bahrain. |

| VAT de-registration situations |

– company liquidation, – when the business did not have any income in the past 12 months, – when the value of the annual expenses and supplies is below the minimum registration threshold for local companies |

Investors who are interested in company formation in Bahrain are not deterred by the recent tax changes. The value-added tax rate remains a small one, with a zero range and reduced ranges for selected goods and services.

Because the VAT law differs from that in the other GCC states, like the United Arab Emirates, it is advisable to reach out to our agents who specialize in company registration in Bahrain for updated information. They are at your service if you want to apply for a VAT number in Bahrain.

VAT registration in Bahrain for foreign companies

Regardless of the thresholds, non-resident companies (those without a fixed place of business or fixed establishment) must register for VAT within 30 days of selling their first taxable stock to non-taxable individuals.

Foreign companies in Bahrain have two options for registering for VAT: either directly with the National Bureau for Taxation (NBT) or by designating a Tax representative to make payments on their behalf.

Bahrain has specific rules for VAT registration. The following are the crucial documents needed to apply online for VAT registration in Bahrain as a foreign enterprise:

- a copy of the certificate of commercial registration

- a report from independent auditors

- an audited financial statement;

- an expense budget report

- information on the relationship between the parent company and its subsidiaries

- a Customs Registration Certificate

- a copy of the Certificate of Incorporation

- copies of identification papers of the person designated to represent the foreign entity.

Should you decide to register for VAT in Bahrain as a foreign entity, feel free to address our company formation specialists. We are also at your disposal if you want to incorporate a branch office or subsidiary in this country.

The Kingdom of Bahrain has implemented a standard rate of 10% Value Added Tax (VAT) as of January 1, 2022. Bahrain’s National Bureau for Revenue (NBR), a government agency in charge of enforcing and collecting VAT. A VAT account number would be given to them once they enrolled. A VAT refund would only be available to registered organizations or individuals with the National Bureau for Revenue (NBR).

The following sales must be taken into account when calculating the VAT threshold:

- standard rated goods;

- zero-rated goods;

- services obtained with a reverse charge;

- imported goods.

Do not hesitate to inquire with us about the latest changes in the VAT registration system in Bahrain.

If you need support in obtaining a VAT certificate in Bahrain, our accountants can help you.

What are the VAT registration requirements for local companies in 2024?

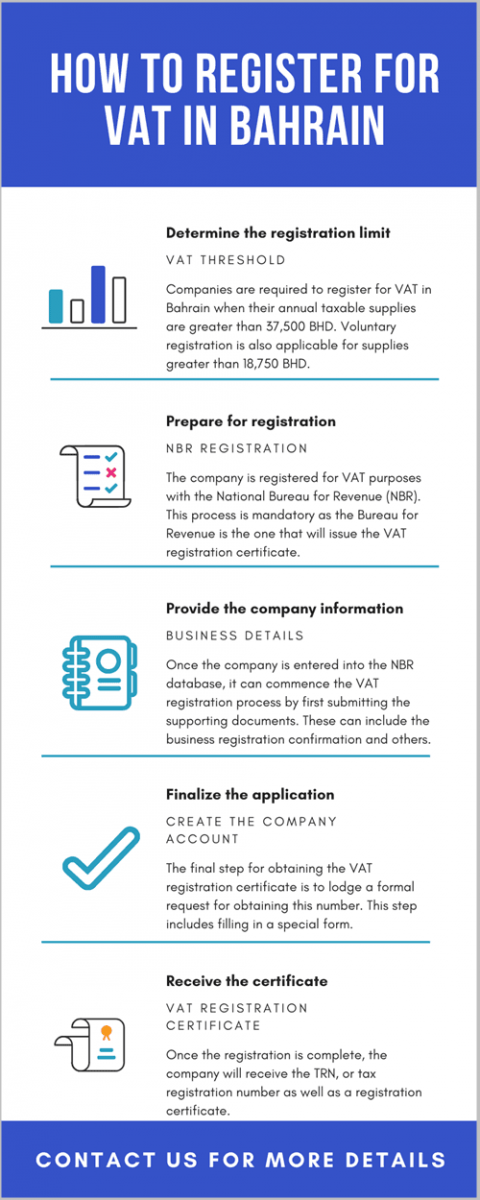

Investors who set up a company in Bahrain will need to register for VAT purposes in 2024 if their annual supplies exceed the mandatory threshold. A transitional period applies until a certain date, however, starting with December 2019, companies are expected to comply with the mandatory registration threshold on supplies greater than 37,500 BHD and a voluntary registration on supplies exceeding 18,750 BHD.

Investors who are interested in company formation in Bahrain will need to follow the guidelines issued by the National Bureau of Revenue regarding the VAT return.

Obtaining a VAT number in Bahrain can be obtained quite simply with our help.

What are the VAT registration steps in Bahrain in 2024?

VAT registration in Bahrain in 2024 is a process that involves five main steps:

- creating the company’s profile with the National Bureau for Revenue (NBR);

- fill in the company details; this includes the taxpayer details, the registration details, financial information and the personal identification details for the registrant;

- submit the request for creating the profile; a successful application will be notified via e-mail;

- receive the login details once the NBR application is approved;

- once the details are available, the taxpayer can log into the virtual portal and complete the registration form.

Once these steps are complete, the company will receive the VAT registration certificate and it will also be assigned a VAT account number. This is also referred to as the Tax Registration Number, the TRN.

One important requirement for investors who set up a company and obtain the VAT certificate in Bahrain is to display this certificate in a visible spot in the establishment. The certificate includes the registration date, the taxpayer information (CR number, name, and address), and the information for registration (VAT account number).

Obtaining a VAT number in Bahrain when reaching the registration threshold

Bahrain has a BD 37,500 minimum threshold for required VAT registration. This means that a Bahraini resident should register for VAT when spending more than BD 500,000 on supplies in the last 12 months, or its projections indicate that more than BD 500,000 will be spent on supplies in the following calendar year.

We remind you that if a non-resident person company in Bahrain makes supplies for which VAT is liable to be imposed, they must register under the VAT law, regardless of the value of the supply. The respective entity has two options for registration: individually or through a tax representative.

Our specialists can offer representation in tax registration matters, including obtaining a VAT certificate in Bahrain and filing VAT returns in accordance with the legal provisions.

Voluntary registration

Compared to other countries, where there is no minimum threshold for VAT registration, in Bahrain things are a little different.

In Bahrain, a person may voluntarily apply for VAT registration in one of the following two situations:

- when registering a turnover of at least BD 18,750 in supplies or expenses over the last 12 months

- when projecting to earn over BD 18,750 on supplies or expenses in the following 12 months.

In Bahrain, the voluntary VAT registration threshold is BD 18,750, or 50% of the required VAT registration turnover.

If you need guidance on obtaining a VAT number in Bahrain, do not hesitate to ask for the support of our accountant.

We are also at your disposal with company formation services in Bahrain.

Each shareholder will receive a special resident permit for investment purposes, as well as resident cards for their dependents – spouse and children – by incorporating a company in Bahrain. Moreover, one can also apply for 2 work permits for foreign employees. Later on, other staff can be relocated here.

How is VAT implemented in Bahrain?

The value-added tax in Bahrain has varying rates, starting with the standard one. These are as follows:

- the standard rate: this is 5% and it will apply to certain goods and services; it is the rate agreed among the GCC countries.

- the zero rate: when supplies are subject to VAT, but the charged rate of 0%; the input VAT can be deducted.

- the exemptions: some types of goods and services are exempted from VAT; these cannot deduct input VAT.

- others: some goods and services are out of the scope of the value-added tax altogether.

Investors who wish to know more about the category in which their business is included can reach out to our agents who specialize in company formation in Bahrain. We are also at your service with support in immigration to Bahrain.

In order to immigrate to Bahrain, you must get acquainted with the requirements for residency. These depend on various factors, however, we can help you choose an appropriate type of residence permit, based on several criteria. Among these, your country of nationality, work experience, or even investment options and possibilities.

Temporary residency in Bahrain is usually the first step to obtain the permanent one. If you are a foreign citizen and want to move here, we advise you to use our dedicated services that are tailored to clients’ needs. Our lawyers understand your need of certainty when it comes to successful and hassle-free relocation, so contact us.

Examples of services that are subject to VAT

To make it easier for investors who wish to set up a company in Bahrain, we list some types of services that are subject to VAT and the respective rates:

- Food: subject to a zero rate for basic foodstuffs and a 5 percent rate for restaurants and coffee shops.

- Healthcare: zero rate for most medical services (general and specialist) and 5 percent rate for cosmetic procedures, the supply of food and beverage to non-patients and other extra services, not related to the medical procedures or the patient.

- Financial services: currencies trading, investment fund services, life insurance, and reinsurance contracts and others are exempt; the 5% rate applies to general insurance, brokerage, discretionary asset management, and others.

- Education: zero rate for kindergartens, primary, secondary and higher education institutions, for printed and digital books and others; the 5% rate for professional education, stationery, food and beverages, and others.

- Oil: gasoline and diesel for motor vehicles, motor oil, gas for ovens are zero-rates.

- Import and export: export services, import of basic foodstuffs and import of medicines and medical equipment are zero-rated.

In the import/export category, services provide in Bahrain by a foreign company are subject to the standard 5% rate and the following are exempt from VAT: the import of equipment used by individuals with special needs, the import of personal luggage and household items, the imports of gifts carried by passengers.

Our team of tax specialists can provide further details on the implementation of this tax according to the specific business field and on obtaining a VAT certificate in Bahrain.

Feel free to address our immigration lawyers in Bahrain for guidance in moving here.

Any changes to the company particulars are to be notified to NBR. Failure to do so may result in the VAT de-registration if the evidence is provided that the company is non-compliant. Upon receipt of the certificate, the holder has the responsibility to ensure that the details are correct.

Other information about VAT in Bahrain

Tax group registration is possible in Bahrain, however, a number of criteria apply:

- all of the companies in the group must be engaged in an economic activity;

- all of the companies must be considered residents for taxation purposes and must obtain VAT certificates in Bahrain;

- the companies must be related, as follows: two or more individuals have a formal partnership arrangement with one control criteria such as a voting interest in each of the entities of at least 50%, a market value interest of at least 50% or control by any other means.

One of our agents who specialize in company formation in Bahrain can provide investors with more details about tax group registration.

In those cases in which a company that should have been subject to VAT registration in Bahrain fails to do so, the NBR may register it automatically starting with the date from which the company should have been registered. All of the VAT due for this period will need to be accounted for.

The usual VAT registration period in Bahrain is 60 days and the NBR can apply penalties after this time. The administrative penalties can be of up to 10,000 BHD and sanctions can also apply for tax evasion.

Companies that are no longer subject to mandatory VAT registration in Bahrain and are not interested in voluntary registration may commence the de-registration process, which includes a simple request made on the NBR portal. It is useful to note that the taxpayer remains subject to the ongoing obligations until the de-registration is approved.

Some of the situations in which de-registration becomes mandatory are the following:

- the company is no longer carrying out an economic activity in the country (for resident and non-resident companies);

- the company has not recorded any taxable supplies for 12 consecutive months;

- when the total value of the annual supplies and expenses in the last 12 months is below the voluntary registration threshold (only for resident companies);

- the total value of the annual supplies and expenses is not expected to exceed the threshold in the coming twelve months (also only applicable to resident companies).

Failure to de-register when this is required may result in administrative penalties. One of our agents who specialize in company registration in Bahrain can provide investors with more details on the penalties that may apply.

Our immigration lawyers in Bahrain can offer detailed information on the country’s tax legislation and the levies that apply to foreigners.

Documentation for VAT purposes in Bahrain and input tax recovery in 2024

Companies that are registered as VAT taxpayers in Bahrain in 2024 need to comply with certain requirements regarding documents and records that are to be kept. The following are mandatory:

- accounting books, with the transactions in chronological order;

- records of all supplies and imports of goods and services;

- balance sheet, profits and loss accounts, salaries records;

- inventory records, fixed assets records, customs documentation for imports and exports.

- others, as needed.

Taxable persons in Bahrain can recover VAT charges on expenses, according to the use of the expenses. For example, VAT charges on the expenses for the purpose of the economic activity can be recovered in whole or in part. Certain conditions apply for this, among which the fact that the input tax claim must be issued within five years, the limit set forth by the VAT Law.

Our agents can help with more information about company registration as well as VAT registration in Bahrain and input tax recovery.

The procedure for obtaining a VAT number in Bahrain in 2024 is the same as in the previous years and investors setting up companies here can rely on the support of our advisors.

If you have questions about the Bahrain VAT rates in 2024, you can direct to our accountants. You can also send us your questions on immigration to Bahrain.

VAT returns in Bahrain

All VAT-registered firms are required to file a tax return to the National Bureau for Taxes (NBT). Businesses must outline the specifics of their purchases, sales, output VAT, and recoverable input for a specific tax period in their VAT return. NBT will specify the VAT return format in which the information must be entered. The NBT has not yet announced the format for the VAT refund. The mandatory information that the registered person must declare in his VAT Return, however, is set forth in the Bahrain Regulations. The returns must contain information about the type of VAT applied, the rate, the value of the tax and the total amount to be paid by the buyer.

We also invite you to watch a video on this subject:

Investing in Bahrain

Bahrain is a jurisdiction that offers a number of advantages to investors. According to recent data:

- in September 2023, Bahrain’s Foreign Direct Investment (FDI) increased by 2.5% of the nation’s Nominal GDP, up from 2.4% in the same quarter the previous year;

- in the latest data of Bahrain’s Current Account, the country had a surplus of USD 569 million in June 2023;

- in June 2023, its foreign portfolio investment climbed by USD 2.0 billion.

Contact our agents who specialize in company formation in Bahrain for more information about the tax requirements and the VAT regime.